- The Idea Farm

- Posts

- Bonds Baby!

Bonds Baby!

+ Man Group, Jeff Currie, Unreasonable Hospitality, US Debt & More

“There is no regulation on Earth that can replace a rudderless conscience.”

Research

Since the Global Financial Crisis, U.S. stocks have enjoyed tailwinds that led asset owners to wave the white flag on global diversification. However, these tailwinds may be gone and, despite slowing relative earnings growth, the valuation gap between U.S. and non-U.S. equities has widened. Acadian argues it may be time to tilt away from U.S. stocks.

Sources: Acadian calculations based on Bloomberg and MSCI Indexes. MSCI data copyright MSCI 2025. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI. For illustrative purposes only. Returns do not reflect actual trading or actual accounts, and they do not include transaction costs. Every investment program has the opportunity for losses as well as profits. Past performance is no guarantee of future results.

Kai Wu distills Warren Buffett’s philosophy into a simple, rules-based strategy that can be implemented using long-only factor building blocks.

Carlyle - The New Martial Plan (28 pages)

As the United States retreats from international cooperation, the world is arguably becoming more dangerous and more expensive. Jeff Currie’s latest looks at the implications of this shifting security landscape.

The authors created a new historical corporate bond database spanning 128 calendar years, comprising nearly 110,000 unique bonds and 8 million observations. This paper walks through the new data set and key takeaways.

Figure 7: Time series of median bond yields. This figure presents the monthly time series of median bond yields, with each data source represented by a distinct color: CFC (blue), S&P Bond Guide (orange), Mergent/Moody’s Bond Record (green), Lehman Brothers (red), and WRDS (purple). All values are expressed in percentages. The sample period is from May 1895 to June 2022.

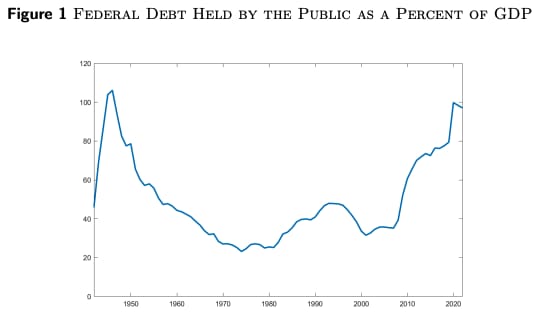

Last year, the IMF released a paper that analyzed the role of three factors to the U.S. public debt/GDP ratio from 106% in 1946 to 23% in 1974: primary budget surpluses, surprise inflation, and pegged interest rates before the Fed-Treasury Accord of 1951. They find that, over the last 76 years, only a small amount of debt reduction has been achieved through growth rates that exceed undistorted interest rates.

Bonus Content - Long Reads

Rethinking Venture Capital (134 pages) Link

Finaeon Guide to Global Stock Markets 2025 Edition (339 pages) Link

Investor Perspectives: Intangible Assets - CFA Institute (144 pages) Link

A Comprehensive Guide to ETFs - CFA Institute (60 pages) Link

Investment Company Fact Book - ICI (154 pages) Link

The power of one: How standout firms grow national productivity - McKinsey & Company (94 pages) Link

Podcasts

Kleinrock helped invent the Internet and supervised the sending of its first message in 1969. He reflects on how the Internet has evolved over time and discusses what the rise of AI means for the future of technology and society. |

Chancellor discusses the century-long evolution of money and interest rates, the political and societal consequences of ‘mispriced’ money, and whether the world is nearing a return to sounder forms of money. |

Schmidt gives an eye-opening look into what he envisions for the future of AI and the impact on society. |

What Else Is Happening

Meb Faber spoke with Mark Higgins about the parallels between historical financial crises and today’s economic landscape. Apple | Spotify | YouTube

Did you miss last week’s email?