- The Idea Farm

- Posts

- The International Rebalance

The International Rebalance

+ Jim Chanos, Cliff Asness, Jason Zweig, RBA, Goldman Sachs & More

Together With

“An ability to detach yourself from the crowd—I don’t know to what extent that’s innate or to what extent that’s learned—but that’s a quality you need.”

Research

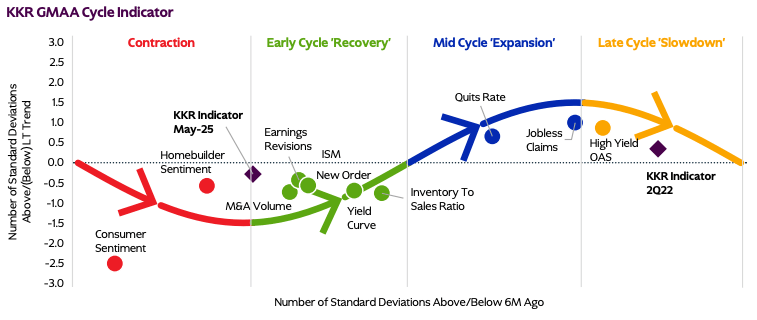

KKR - Mid Year Outlook: Make Your Own Luck (68 pages)

KKR’s ‘Glass Still Half Full’ thinking is that attractive financial conditions, a global easing cycle, ongoing productivity gains, and lack of net issuance—coupled with some incredibly powerful investment themes—will continue to drive this cycle both further and longer than many think.

Note: Meb will have KKR’s Henry McVey on the podcast to discuss these views soon. Subscribe here: Apple | Spotify | YouTube

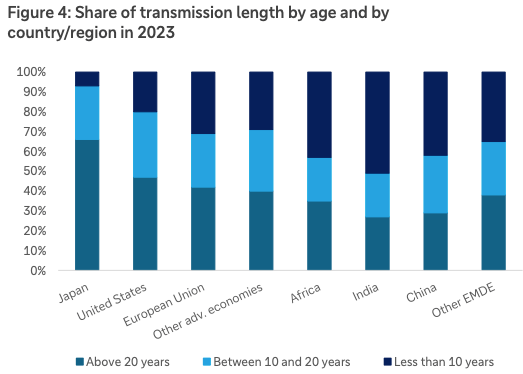

Deutsche Bank provides an overview of electricity and grid development, a summary of investment trends in grid expansion, and the investment case for Utilities.

The chart below highlights that at least 40% of the grid is already more than 20 years old in advanced economies.

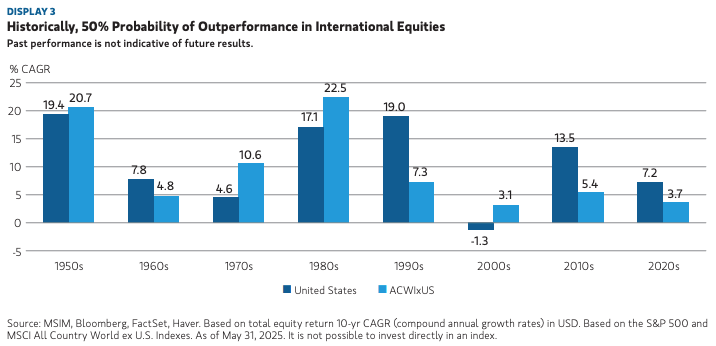

Jitania Kandhari explains why the balance of risk and reward has shifted after 15 years of U.S. equity dominance. She suggests it will not be about abandoning U.S. exposure, but restoring balance and positioning portfolios for the next decade.

With the commercial real estate landscape shaped by structural uncertainty, PIMCO says it’s time to be more selective and not rely on traditional approaches anchored in broad sector allocations and momentum-driven strategies.

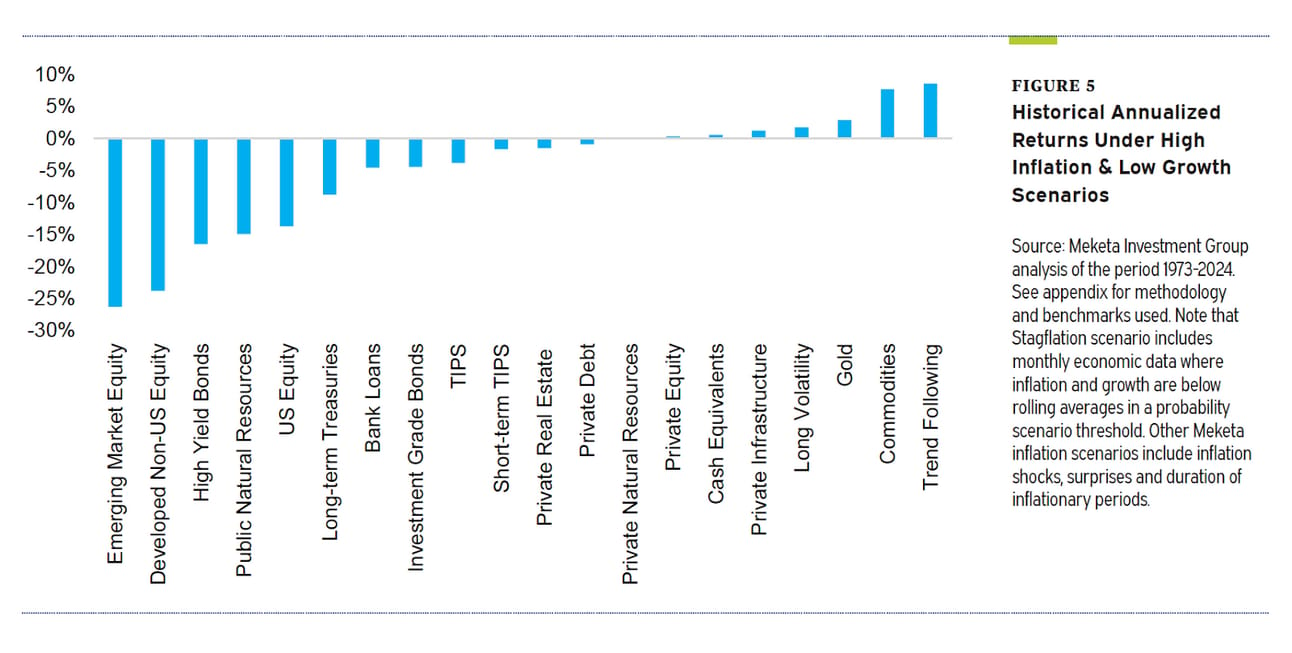

Meketa goes into the possible return of stagflation, and which handful strategies have historically outperformed in that environment.

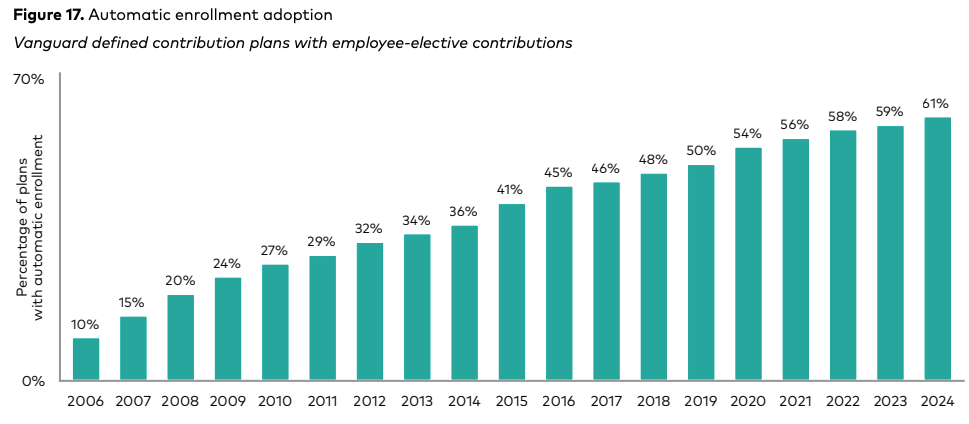

Vanguard - How America Saves 2025 (112 pages)

Vanguard’s annual report looks at the saving behaviors of nearly 5 million participants in Vanguard retirement plans.

Bonus Content

Some funds are yield magicians. Jason Zweig looks at how they do it. Link

“A dividend in hand is worth two expensive growth stories.” Link

Is big tech experiencing short-term margin pains for long-term AI efficiency gains? Link

Goldman Sachs Asset Management explores the USD's decade of dominance, drivers behind its recent uncharacteristic weakness, and why it remains strategically relevant for investors. Link

The 10th edition of the IEA’s World Energy Investment shares an update on the industry amid elevated geopolitical tensions and economic uncertainty. Link

SPONSORED BY INKIND

EXPLORE, DINE & EARN

Enjoy 20% back at thousands of restaurants, plus exclusive access to perks, offers and events only available to inKind diners.

Search For Restaurants - In the inKind app, tap Search to discover restaurants. You can search by location, restaurant name, or cuisine type.

Pay Your Bill - Once you’ve picked a spot, enjoyed a delicious meal, and received your bill, tap PAY and follow the on-screen prompts to close out.

Earn 20% Back - By dining with inKind, you'll earn 20% inKind Cash back— added directly to your inKind wallet.

Podcasts

Asness talks about about value and momentum, meme stocks, market timing, explaining factors, how much to charge for alpha, private assets and machine learning. |

Former Microsoft Windows chief Steven Sinofsky shares a thoughtful view on how Apple’s pursuit of design excellence and supply chain scale catalyzed China’s manufacturing superpower status - and why that partnership is now under intense scrutiny. |

Jim Chanos shares his thoughts on MicroStrategy, data centers, Carvana, Zohran Mamdani and more. |

What Else Is Happening

Meb Faber spoke with Wes Gray & Srikanth Narayan about 351 ETF conversions and exchange funds. Apple | Spotify | YouTube

We shared 50 facts from the first half of 2025, including "total wine consumption is down more than 80% in France since 1945.”

Did you miss last week’s email?